Oil settles unchanged as latest storm spares U.S. energy sector

Brent crude settled up 9cents to$73.60 a barrel after hitting a session high of $74.28. U.S. West Texas Intermediate (WTI) crude settled up 1 cent, at $70.46, after touching a high of $71.22.

More than 39% of the U.S. Gulf of Mexico's production of crude and natural gas remained shut on Tuesday, the regulator Bureau of Safety and Environmental Enforcement (BSEE) said. Nicholas made landfall in Texas on Monday and was to reach Louisiana on Wednesday, bringing more floods and heavy rains to the Gulf's oil facilities.

''The Gulf situation is not resolving itself quickly,'' said John Kilduff, partner at Again Capital LLC in New York.

Royal Dutch Shell (RDSa.L) shut production at an offshore oil platform due to heavy winds. Vessel traffic at some energy hubs was halted due to difficult weather conditions.

''There's going to be import-export issues because Houston is in a semi-flood zone,'' said Bob Yawger, director of energy futures at Mizuho.

Nicholas is the second major storm to threaten the U.S. Gulf region in recent weeks, bringing heavy rains to the Deep South and causing power outages. Still, most Texas refineries were operating normally and Texas utilities were restoring power to customers who suffered outages. read more

The Colonial pipeline, the largest U.S. fuel pipeline, partially resumed operations after shutting due to a power outage early in the day.

Oil turned negative during the session after new data from the U.S. Labor Department showed inflation cooling and as worries receded about the storm's impact on the energy sector. read more

After three months of declining global oil demand, rollouts of COVID-19 vaccines should rekindle appetite for oil that was suppressed by pandemic restrictions, especially in Asia, the International Energy Agency (IEA) said on Tuesday.

The IEA sees a demand rebound of 1.6 million barrels per day (bpd) in October and continued growth until the end of the year.

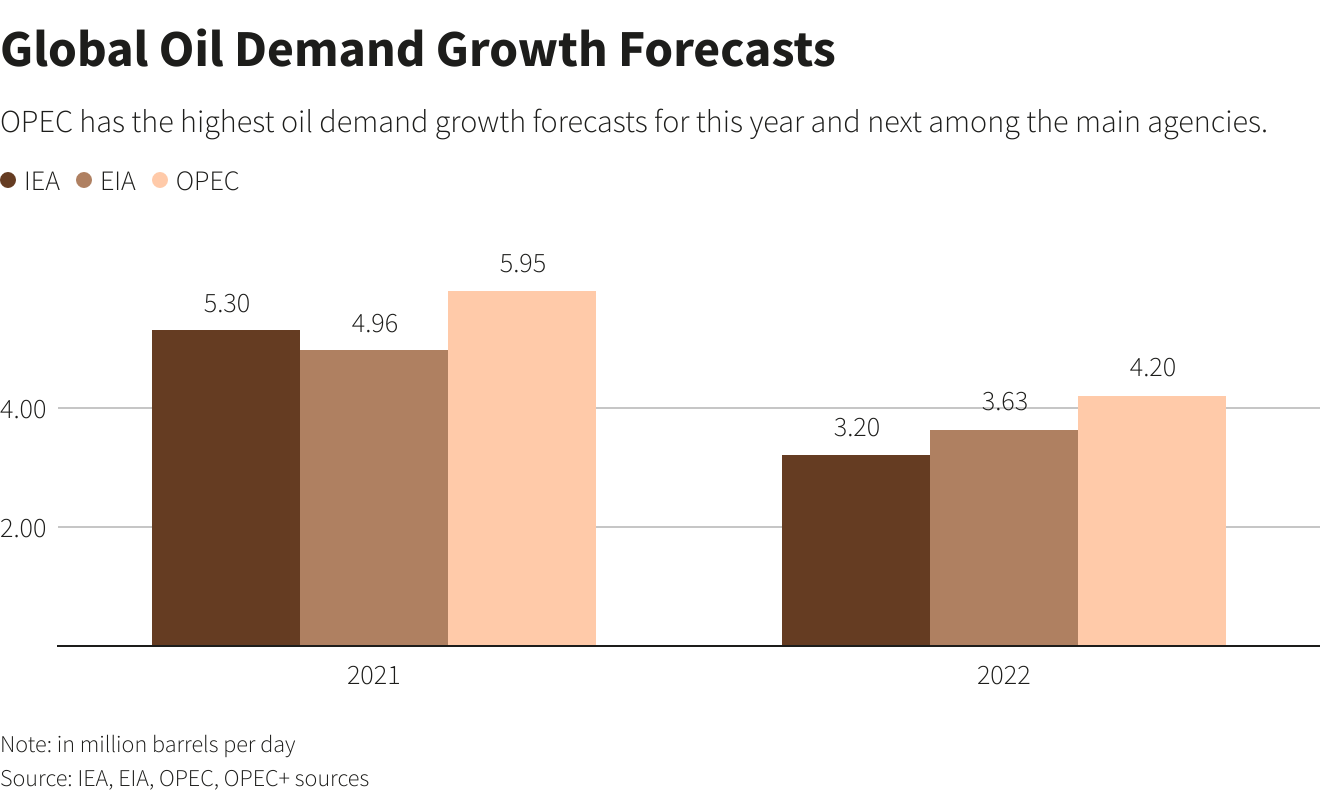

Overall, the agency lowered its 2021 global oil demand growth forecast by 105,000 bpd to 5.2 million bpd but raised its 2022 figure by 85,000 bpd to 3.2 million bpd.

These forecasts are below those of the Organization of the Petroleum Exporting Countries (OPEC), which expects demand to grow by about 5.96 million bpd this year and 4.15 million bpd next year. read more

Protesters blocked an oil tanker from loading at the Libyan terminal of Es Sider on Tuesday, the National Oil Corp's (NOC) media office and an engineer at the port said.

Details on China's plans to sell crude from strategic reserves pressured prices. China's state reserves administration said it would auction about 7.4 million barrels of crude on Sept. 24.